Multi Vendor Strategy is the New RPA Normal

May 2, 2022 – Antti Karjalainen

RPA has been going through a huge boom in the last six years and now we are about to see a shift in how enterprises adopt RPA. Now I’ve been following the RPA space since 2016 and this is what I’ve seen.

2016-2018: 1st gen winners appear to the big audience... There are talks about “a bot for every employee” and RPA is framed as a magical AI driven tech that simply watches what you do and automates that. A ton of focus was placed on attended and desktop bot use-cases.

2019-2020: I counted at least 100 RPA tech vendors on the market. It seemed that there was a new tool coming out every week. A lot of consolidation started happening as well when big platforms started to acquire RPA capabilities.

There was little to no differentiation between the upstarts. Many vendors were touting intelligent automation, hyperautomation, cognitive automation and really saying just about anything they could come up with to differentiate their brand in the crowd. Industry pundits were big on fantasies about autonomous intelligent bots but the reality in the IT trenches couldn’t be further from that.

At the same time there were a lot of skeptics asking if RPA is a band-aid technology and questioning if it would ever become a real market category.

Citizen developers were still the focus of the analyst industry but customers began seeing more value from headless to unattended automation - an example of this was bots that crunch big back office workloads. It’s clear that RPA isn’t a tech where citizen developers create magical assistants on their desktop and instead every company is standing up teams to operate RPA internally.

2021-2022: RPA has been validated as a “must have” for every enterprise. We’ve seen teams running hundreds of bots and felt the pain of scaling. 1st gen winners start expanding TAM by adding features in areas like document processing, process discovery, API connectivity.

Today I’m seeing a lot of software vendors looking to add RPA capabilities into their products. My bet is that every single integration platform will have RPA-like capabilities within two years. There’s also a push by RPA service providers into the mid-market – more on that some other time.

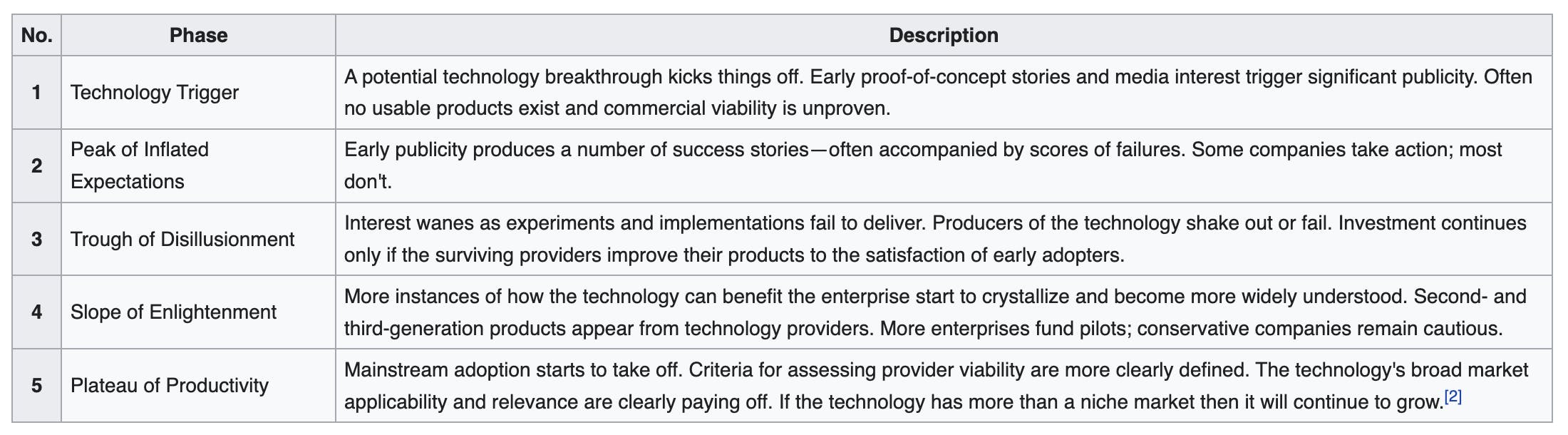

I think we are at a point in the RPA hype cycle that we are coming out from a slump in expectations.

So where does the enterprise go with RPA from here? We know what’s working, how it's working, what’s real and what’s fantasy. 1st gen platforms have gotten so big and complex, not to mention expensive and heavy to operate. They might be good at the basic RPA tasks but mediocre at best in everything around that.

I know it’s just one stock but UiPath hasn’t performed well against the S&P tech index for a variety of reasons. Looking back on UiPath’s move to becoming a publicly traded company, it is clear it was built with a significant amount of hype revolving around the promise of a one-stop “fully automated enterprise” and being the next SAP. Sure the market is pulling the rug under many other tech stocks as well but $PATH is right up there with Peloton and Zoom. Another 1st gen leader, Blue Prism, was just purchased by a private equity firm.

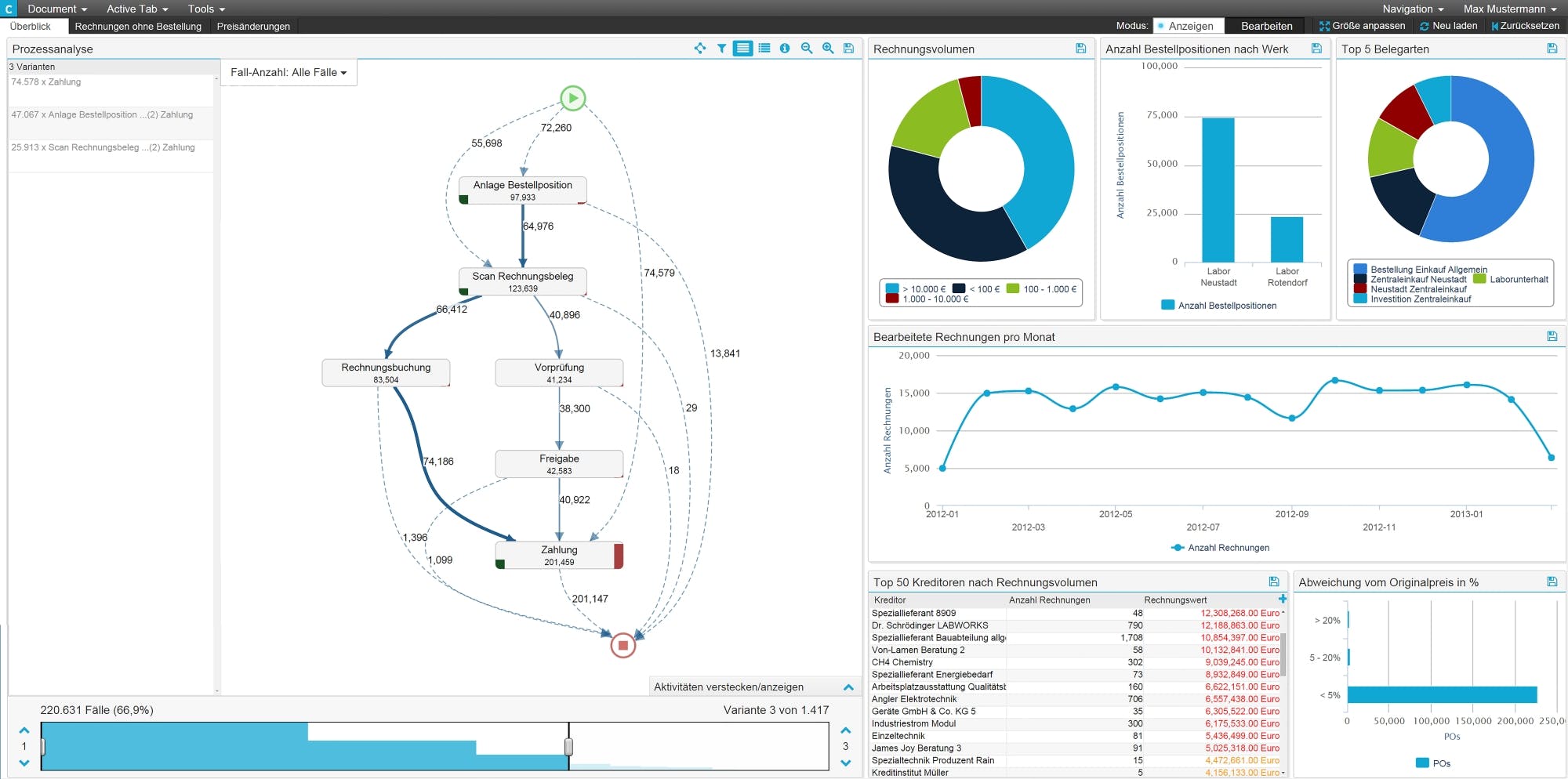

According to Gartner, by 2024, 40% of RPA buyers will utilize a multi-vendor strategy. This points to a different future than the vision of single enterprise wide automation platforms taking over. We have dedicated technologies, such as Instabase for dealing with unstructured documents, and Celonis for understanding processes.

We started working on Robocorp in 2018 and incorporated in 2019 with a vision to build an open-source technology stack and community for RPA developers. It was a counter move to the early hype about magic and AI in business process automation. We knew that citizen developers cannot ship big and powerful headless automations and that’s where a lot of the value is going to be generated.

We also missed some things with our initial idea. The shift to cloud has been slower than expected, although enterprise loves our cloud-native pricing that’s based on consumption. We also underestimated the power of low-code when done right and that’s why we’ve course corrected and built Automation Studio.

An important side note, low-code in RPA isn’t about enabling everyone to build bots. Just look at low-code game development platform Unity that started with a vision to enable everyone to make games, but it’s still a complex professional tool. This is how we see low-code and RPA, and we’ve created a tool that’s easy to pick up and powerful to use for the long term.

Now, observing the shift in RPA narratives, I think we are at a point where a dual aka multi vendor strategy will be key for success in enterprise RPA. Looking at Wikipedia definitions of the hype cycle phases, it’s safe to say that we’re entering phase 4.

The future of RPA is bright in the sense that it’s getting used by more and more companies every day, and those companies are seeing real value. Some of our enterprise customers have seen massive improvements in TCO by replacing their old bots with Robocorp. Many others are looking to add a second RPA vendor because they don’t want to be locked in and get stuffed with more features they don’t use.

There is not going to be a single platform that powers hyper-automation for the enterprise. Instead we are going to see that in 2022-2023 more enterprise RPA users will add complementary technologies into their operations and by doing that, they will have access to the best of each category.